Understanding the Medicare Annual Enrollment Period (AEP)

AEP Explained: Your Key to Better Medicare Coverage

The Medicare Annual Enrollment Period (AEP) is a pivotal time for millions of Americans who rely on Medicare for their health care coverage. This yearly event allows beneficiaries to make important decisions about their health plans, ensuring they have the right coverage tailored to their unique needs. With the ever-changing landscape of healthcare, AEP is an opportunity not to be missed.

What is AEP?

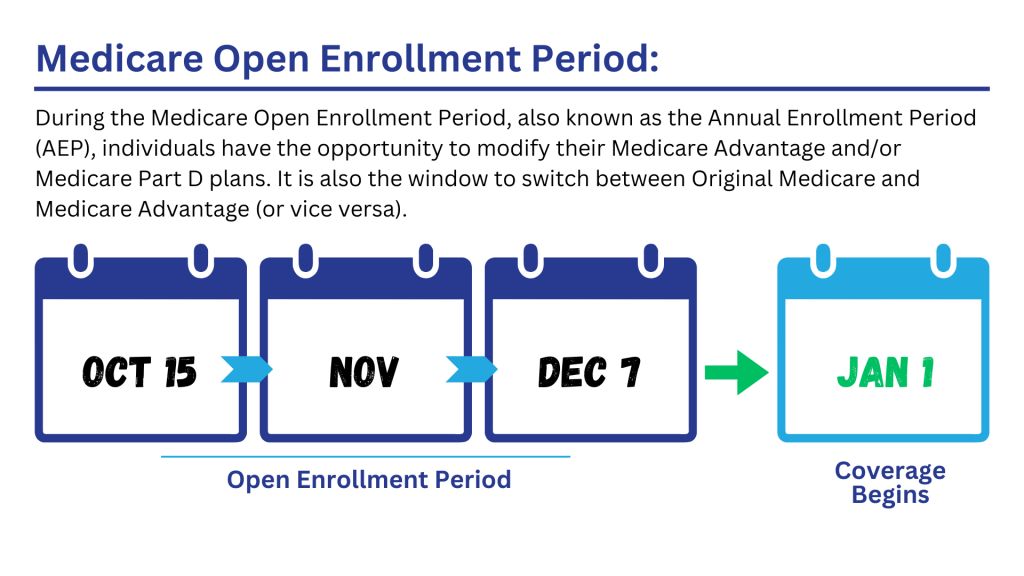

The Medicare Annual Enrollment Period takes place from October 15 to December 7 each year. During this window, beneficiaries can make a variety of changes to their Medicare coverage, including:

- Switching from Original Medicare to a Medicare Advantage Plan (or vice versa)

- Changing from one Medicare Advantage Plan to another

- Enrolling in or switching Part D prescription drug plans

- Making adjustments to existing Part D coverage

These changes become effective on January 1 of the following year, allowing beneficiaries to start the new year with a plan that better fits their health care needs.

Why is AEP Important?

Review Your Coverage: Individual health needs can evolve due to age, medical conditions, or lifestyle changes. AEP encourages beneficiaries to reassess their current plans to ensure they provide adequate coverage.

Cost Savings: Different plans may offer varying premiums, deductibles, and out-of-pocket costs. By reviewing options during AEP, beneficiaries can potentially find plans that offer better financial terms, including lower co-pays or more comprehensive coverage.

Access to New Benefits: Each year, Medicare plans may introduce new benefits or enhancements. AEP is your chance to take advantage of these offerings, which could include expanded telehealth services, wellness programs, or additional preventive care.

How to Prepare for AEP

Preparation is key to making the most of the Annual Enrollment Period. Here are some steps beneficiaries can take:

Review Your Current Plan: Start by examining your existing Medicare coverage. Look at your benefits, costs, and any changes that may have occurred over the past year. Make note of any issues you faced, such as high out-of-pocket expenses or difficulty accessing care.

Compare Plans: The Medicare Plan Finder is an invaluable tool for beneficiaries. Utilize this resource to compare various plans available in your area. Consider factors like monthly premiums, deductibles, coverage of your preferred doctors and hospitals, and whether your necessary medications are included in the formulary.

Check Your Medications: A critical step is ensuring that your prescriptions are covered under any new plan you are considering. The costs associated with medications can vary significantly between plans, so confirming coverage is essential.

Stay Informed: Attend local seminars, webinars, or informational sessions about Medicare options and changes. Many organizations and insurance agents host events to help beneficiaries understand their choices.

Gather Necessary Information: Before the enrollment period starts, compile important documents such as your current Medicare card, a list of your prescriptions, and information on your healthcare providers. This will make the comparison process smoother and more efficient.

Making Changes

TrustInsure is here to help with personalized support. Our licensed agents have the expertise to guide you through your Medicare options and ensure you make informed decisions. Beneficiaries can call us at 910-994-6464 to set an appointment. We understand that everyone’s healthcare needs are unique, and we’re dedicated to finding the right plan for you. Call us today or visit our website to learn more about how we can assist you during this important enrollment period.

Conclusion

The Medicare Annual Enrollment Period is a vital opportunity for beneficiaries to review and adjust their health coverage. It’s a time for reflection on your health needs and a chance to ensure you have the best plan for the upcoming year. Taking the time to understand your options, prepare adequately, and make informed decisions can lead to improved health outcomes and significant financial savings.

Originally from South Carolina, I have been a resident of Moore County since 2017 and have assisted hundreds of residents in the Sandhills with the Medicare enrollment process.

I am certified with many top Medicare Advantage, Prescription Drug and Medicare Supplement insurance plan carriers. I represent most major companies with a Medicare contract and am qualified to answer any questions you may have.

At no cost, I will help you find a health plan that best suits your personal needs and budget. By educating you on all the options available, I hope to give you the power to compare and the freedom to choose. My primary goal is to maintain a personal and accessible approach with my current and future clients. I look forward to working with you. Please click here or the calendar link below to schedule a free consultation.

You can also visit our Contact Us page here.